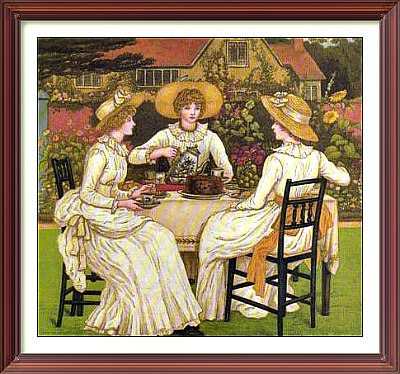

Afternoon Tea: Painting by the Victorian artist Kate Greenaway for Girls' Own Paper. Image cropped.

![]() How to run stable diffusion with no fuss: runpod | For the best frame for your pic, click here | Advertise here | gre作弊 gre保分 gre代考 gre代考靠谱吗 gre替考

How to run stable diffusion with no fuss: runpod | For the best frame for your pic, click here | Advertise here | gre作弊 gre保分 gre代考 gre代考靠谱吗 gre替考

Blog: May 4, 2019: This is a detail of a sentimental illustration from a forgotten book called Queen of the Meadow, by Robert Ellice Mack. Such works were the first to be written to appeal to the interests and fantasies of children. In earlier ages, the aim had been to exhort the child to pray regu-

Blog: May 4, 2019: This is a detail of a sentimental illustration from a forgotten book called Queen of the Meadow, by Robert Ellice Mack. Such works were the first to be written to appeal to the interests and fantasies of children. In earlier ages, the aim had been to exhort the child to pray regu-

larly and generally lead a God-fearing life. See the whole picture here. Previous blog posts are here.

– Logan Brockhurst, hasbara (at) hotmail.co.nz

Click on the icons below for my articles on mental illness and my photos of imperial China, repectively. Sorry, the links are not active yet. Please check back after a week.

|

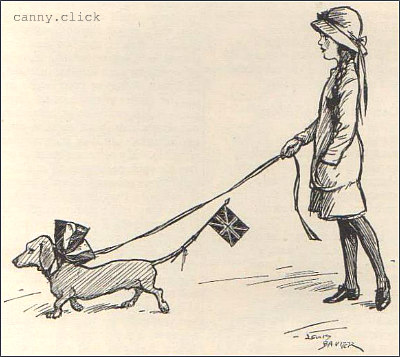

Patriotic dachshund: From Punch, September, 1914.

Click here to see the German dachshund begging.

Cliquez ici pour voir le teckel allemand mendier.

1870: Le dos de la France est contre le mur.

![]() Vaxnix.com: A chronology of vax hysteria in NZ.

Vaxnix.com: A chronology of vax hysteria in NZ.

![]() Wiggle.space: Published poems of Alan Ireland.

Wiggle.space: Published poems of Alan Ireland.

![]() Tony Curran: Rise and fall of a wannabe journalist.

Tony Curran: Rise and fall of a wannabe journalist.

![]() Click for more of my domains and links.

Click for more of my domains and links.

tures from early Aotearoa / New Zealand, click here.

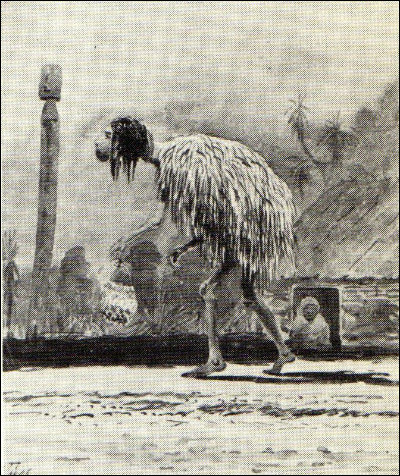

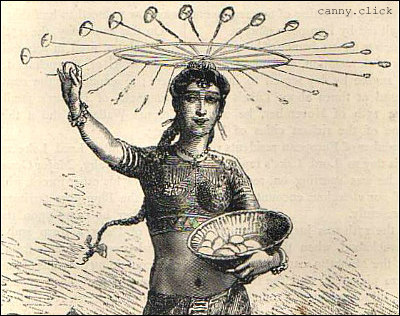

India in the 1700s-1800s: Scenes from Cassel's Illustrated History of India, Vol. I, by James Grant, published in 1876. Click here to view the gallery.

(The above picture shows a girl performing the

"egg dance". Click it to see it in full size.)

Adverisement: eligibility to appear at indian upsc civil service exam is simply a graduation but there are non conventional streams that are also eligible but are not expressly mentioned in upsc notification, and hence there is a lot of confusion - click - ias vision to get details of all the queries, doubts, etc. you can send mails to get clarity on all contentious issues. we hope to answer most of them to help you take the right decision given the circumstances and avoid precious time, since UPSC rarely answers